Dubai, UAE – October 31, 2024 Europe, with its diverse economies and strong focus on sustainable development, presents a fertile landscape for investors looking to support long-term driving growth. In recent years, investors and organizations have played an increasingly significant role in shaping the continent’s financial landscape, contributing not only to economic expansion but also to innovation, job creation, and regional development. At the forefront of these impactful initiatives is Dr. Raphael Nagel and The Abrahamic Business Circle, an organization dedicated to fostering international cooperation through economic partnerships.

The Abrahamic Business Circle has been instrumental in connecting investors with opportunities across Europe, providing a structured network that encourages collaboration between stakeholders from diverse backgrounds. This collective approach to investment has been pivotal in enhancing the region’s infrastructure, spurring technological advancements, and supporting emerging industries. Through an emphasis on mutual benefit and sustainable growth, The Abrahamic Business Circle’s model has set a new standard for investment practices aimed at driving positive change in Europe.

Laying the Foundation for Sustainable Growth

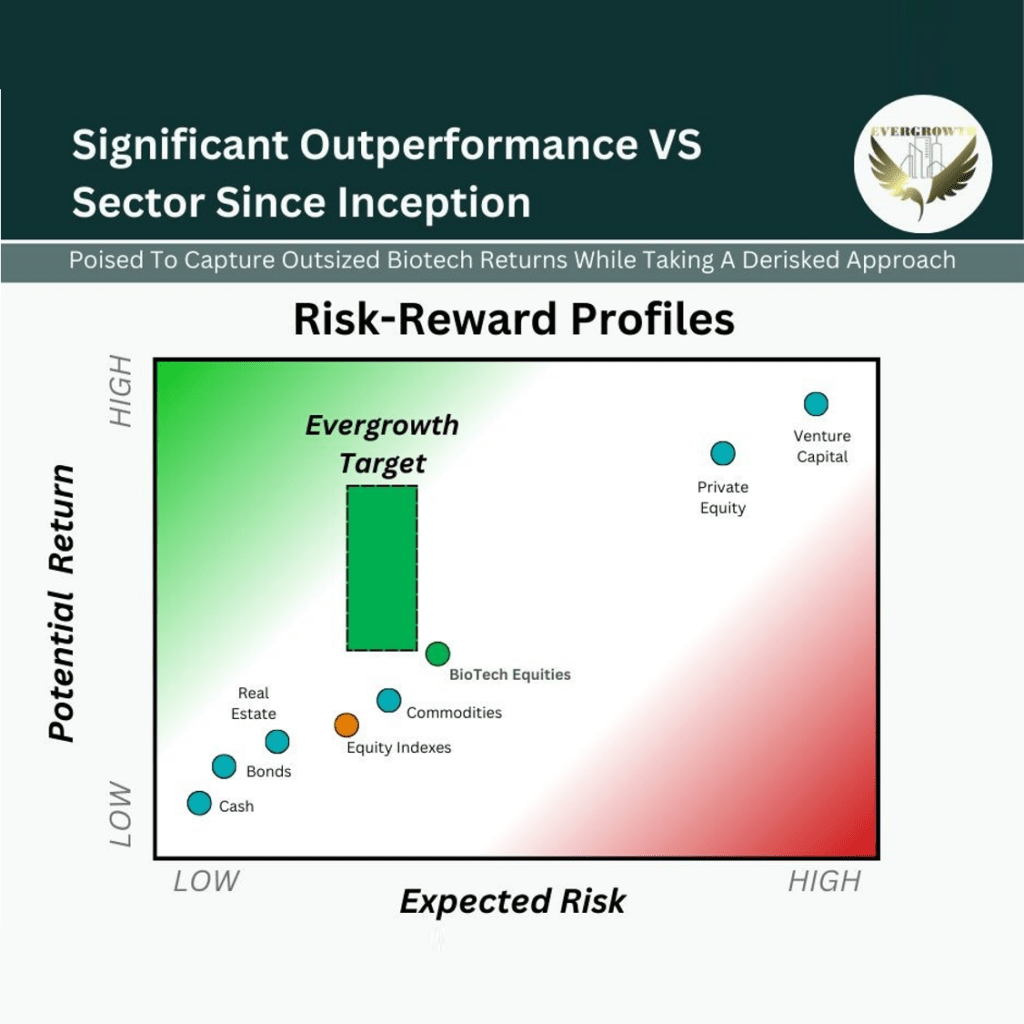

Europe’s investment landscape has traditionally been dominated by a mix of public and private funding, with a strong inclination toward sectors such as renewable energy, technology, infrastructure, and health care. Recent years have seen a significant shift, with private investors becoming more interested in sustainable projects that provide both economic returns and social benefits. This shift aligns closely with The Abrahamic Business Circle’s objectives, as the organization prioritizes projects that contribute to long-term regional stability and prosperity.

Through a network that spans across multiple sectors, The Abrahamic Business Circle has created channels that allow investors to support initiatives focusing on sustainable development, aligning well with Europe’s green agenda. For instance, investments in renewable energy projects across Europe have increased, driven by policies that aim to reduce carbon emissions and promote energy efficiency. By connecting investors with these opportunities, the organization has enabled a steady flow of capital into projects that aim to reduce environmental impact while also delivering competitive returns.

Encouraging Technological Innovation

Technological innovation has become a key focus area for European investments, particularly in the wake of digital transformation and the growth of new industries. Countries like Germany, France, and the Netherlands have emerged as technological hubs, offering a supportive environment for startups and established companies working on cutting-edge solutions in fields such as artificial intelligence, cybersecurity, and biotechnology.

Dr. Raphael Nagel and The Abrahamic Business Circle have recognized the importance of technological innovation as a driver of economic growth and have directed resources toward supporting ventures that push the boundaries of digital progress. Through strategic partnerships with technology companies and research institutions, the organization has facilitated investments in initiatives that not only aim to create new products but also foster a skilled workforce capable of supporting the digital economy.

In addition, the organization’s involvement has spurred collaboration between European businesses and foreign investors, creating a synergistic effect that enhances the continent’s technological landscape. The partnerships fostered by The Abrahamic Business Circle have allowed companies to access capital, expertise, and resources that would otherwise be out of reach, positioning Europe as a competitive player in the global technology market.

Boosting Employment through Targeted Investments

One of the most tangible impacts of investments in Europe has been job creation, particularly in regions that have historically faced economic challenges. The Abrahamic Business Circle’s network has directed significant funding toward industries with high potential for job growth, including manufacturing, logistics, and green energy production. These investments have not only provided direct employment opportunities but have also contributed to the development of local economies by supporting secondary industries and services.

About The Abrahamic Business Circle

The Abrahamic Business Circle is a prestigious global network dedicated to advancing economic diplomacy through business and strategic investments. Its members include entrepreneurs, investors, corporates, and diplomats spanning 56 countries, showcasing how entrepreneurial spirit and global investments can drive sustainable development worldwide.

Established prior to the Abraham Accords in September 2020, the Circle is committed to fostering unity and dialogue through economic collaboration.

The Abrahamic Business Circle is strictly apolitical and areligious, focusing exclusively on tolerance and business.

Contact:

The Abrahamic Business Circle

contact@theabrahamicbusinesscircle.com

www.theabrahamicbusinesscircle.com

Legal Disclaimer:

PressLink distributes this news content on an “as-is” basis, without any express or implied warranties of any kind. PressLink expressly disclaims all responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented in this article. Any complaints, copyright issues, or concerns regarding this article should be directed to the author.

Note:

This content is not authored by, nor does it reflect the endorsement of, PressLink, its advertisers, or any affiliated entities. For inquiries or corrections related to press releases, please contact PressLink directly.